|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

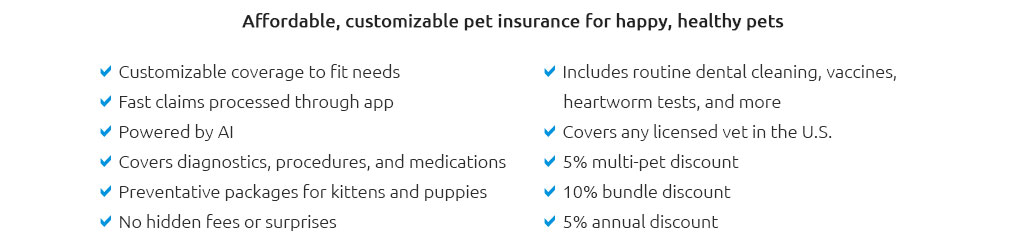

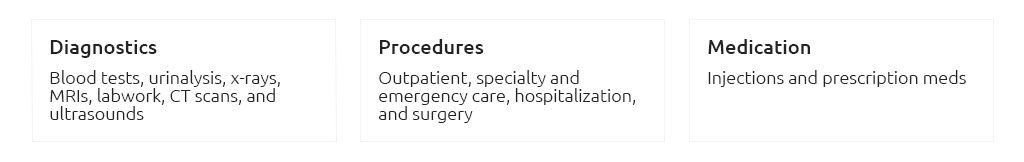

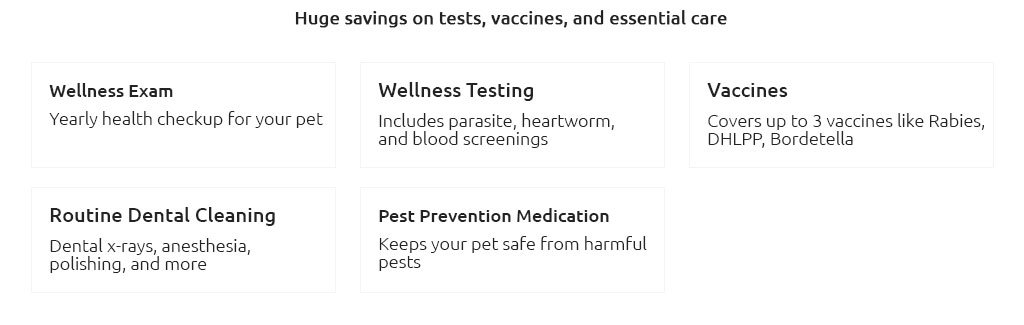

medical insurance plans for dogs made practical and cost-smartYou want fewer surprise bills, faster answers, and care that doesn't stall while you figure out money. The right policy helps you move, not hesitate. What coverage usually meansPlans typically split into accident-only and accident + illness. Many add optional wellness (vaccines, checkups), but that's budgeting, not true insurance. Focus on what protects you from expensive, unpredictable stuff.

How pricing worksYour cost blends premium + deductible + coinsurance until the annual limit. Lower premiums often mean higher out-of-pocket when things go wrong. Choose efficiency: pay a bit more monthly if it prevents big cash shock later.

Plan types, simply

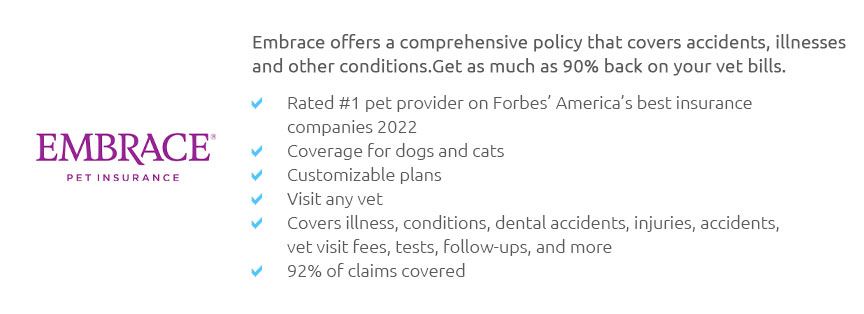

Let me step back. "Comprehensive" sounds universal, but it's really accident + illness plus optional extras; the exclusions still rule the fine print. Experience that saves timeSpeed matters when you're stressed. Look for app-based claims with photo receipt upload, direct pay to ER/specialists when available, quick reimbursements (days, not weeks), and a clear waiting-period clock you can see in your account. A 24/7 vet chat is a quiet win - triage now, not later. A quick real-world momentYour lab mix swallows a sock at 10 p.m. You head to the ER, authorize imaging, and surgery happens before midnight. You submit the invoice on your phone in the parking lot. Three days later, funds land in your account. The key isn't just savings; it's that you didn't pause care to do math. How to compare, fast

What to watch in the fine print

Smarter deductible choicesPick an annual deductible, not per-condition. If you'd tap savings for small stuff, choose a higher deductible and solid 80 - 90% reimbursement. If you hate variability, lower the deductible and keep reimbursement moderate. Efficiency is matching cash flow to risk, not chasing the cheapest premium. If your dog already has issuesKnown problems are usually excluded, but a policy can still protect against unrelated emergencies or future illnesses. Get a thorough exam now to establish a clean baseline for everything else. Sign-up timingEnroll before big breed risks tend to appear and ahead of travel or sports seasons. Puppies get broader eligibility; seniors can still qualify but may face limits and higher costs. Start the clock early so waiting periods are behind you. Quick checklist

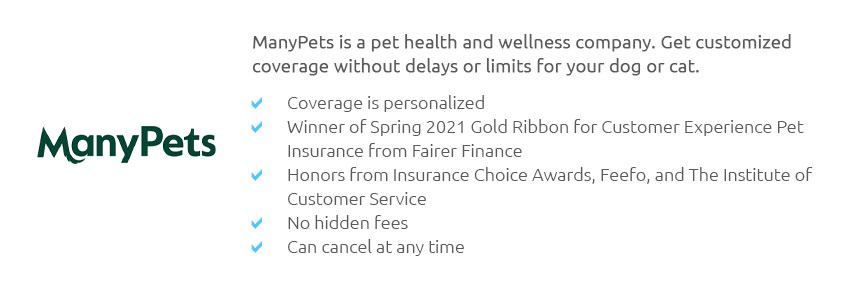

Bottom lineMedical insurance plans for dogs pay off when they prevent delays and smooth out big bills. Prioritize clear coverage, fast claims, and terms that fit how you actually use care. Do that, and you buy back time, confidence, and better outcomes for your dog.

|